Market Overview

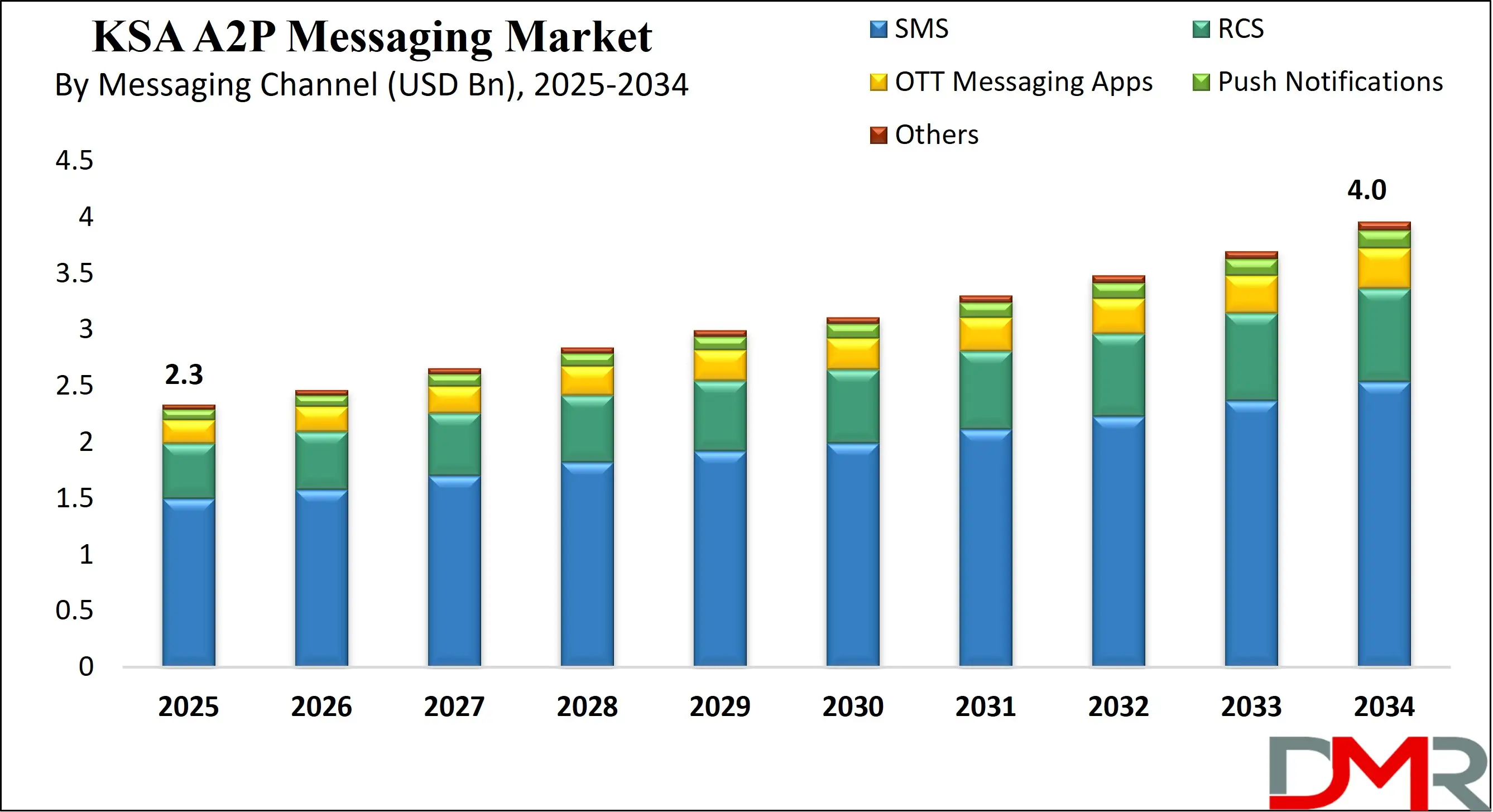

The

KSA A2P messaging market is projected to reach

USD 2.3 billion in 2025, with expectations to grow to

USD 4.0 billion by 2034, registering a

CAGR of 6.0% during the forecast period. This growth is driven by rising enterprise adoption of SMS, WhatsApp Business API, and RCS messaging for customer engagement, authentication, and service alerts across sectors such as banking, retail, healthcare, and public services.

A2P messaging, or application-to-person messaging, is a communication method where automated systems and software platforms send messages directly to individuals' mobile devices. These messages are commonly used by businesses and institutions for purposes such as transaction confirmations, service alerts, appointment reminders, marketing promotions, and two-factor authentication. Unlike peer-to-peer messaging, A2P interactions are typically one-way and are initiated from platforms like banking systems, CRM tools, healthcare portals, or government applications.

A2P messaging spans multiple channels including SMS, WhatsApp Business API, Rich Communication Services, and mobile push notifications, ensuring that enterprises can deliver timely and relevant information to users regardless of device or network. It plays a crucial role in customer engagement, digital communication strategies, and enhancing real-time interaction between organizations and their audiences.

In Saudi Arabia, the A2P messaging market is growing rapidly as digital infrastructure strengthens and public and private sectors embrace cloud communication technologies. The Kingdom’s focus on digital transformation under Vision 2030 has significantly increased the demand for secure and scalable messaging solutions across industries such as finance, e-government, healthcare, and e-commerce. Enterprises are leveraging A2P communication tools to enhance customer service, drive operational efficiency, and meet regulatory requirements for authentication and privacy. The rise in mobile banking, online retail, and health tech platforms has further accelerated the volume and value of application-based messaging in the region.

The Saudi market benefits from high smartphone penetration, strong telecom coverage, and a digitally active population, making it ideal for advanced messaging solutions. Telecom providers such as STC, Mobily, and Zain, along with regional CPaaS platforms like Unifonic and Cequens, are enabling multi-channel messaging that includes SMS, WhatsApp, and RCS. With growing adoption of artificial intelligence, real-time analytics, and personalized communication flows, businesses in the Kingdom are moving toward omnichannel engagement strategies.

The A2P messaging landscape in Saudi Arabia is evolving into a critical enabler of digital services, customer outreach, and business automation, positioning the country as a leading player in the Gulf’s enterprise messaging ecosystem.

KSA A2P Messaging Market: Key Takeaways

- Market Value: The KSA A2P messaging market size is expected to reach a value of USD 4.0 billion by 2034 from a base value of USD 2.3 billion in 2025 at a CAGR of 6.0%.

- By Component Segment Analysis: Platform components are anticipated to dominate the component segment, capturing 61.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based deployment mode is poised to consolidate its dominance in the deployment mode segment, capturing 73.0% of the total market share in 2025.

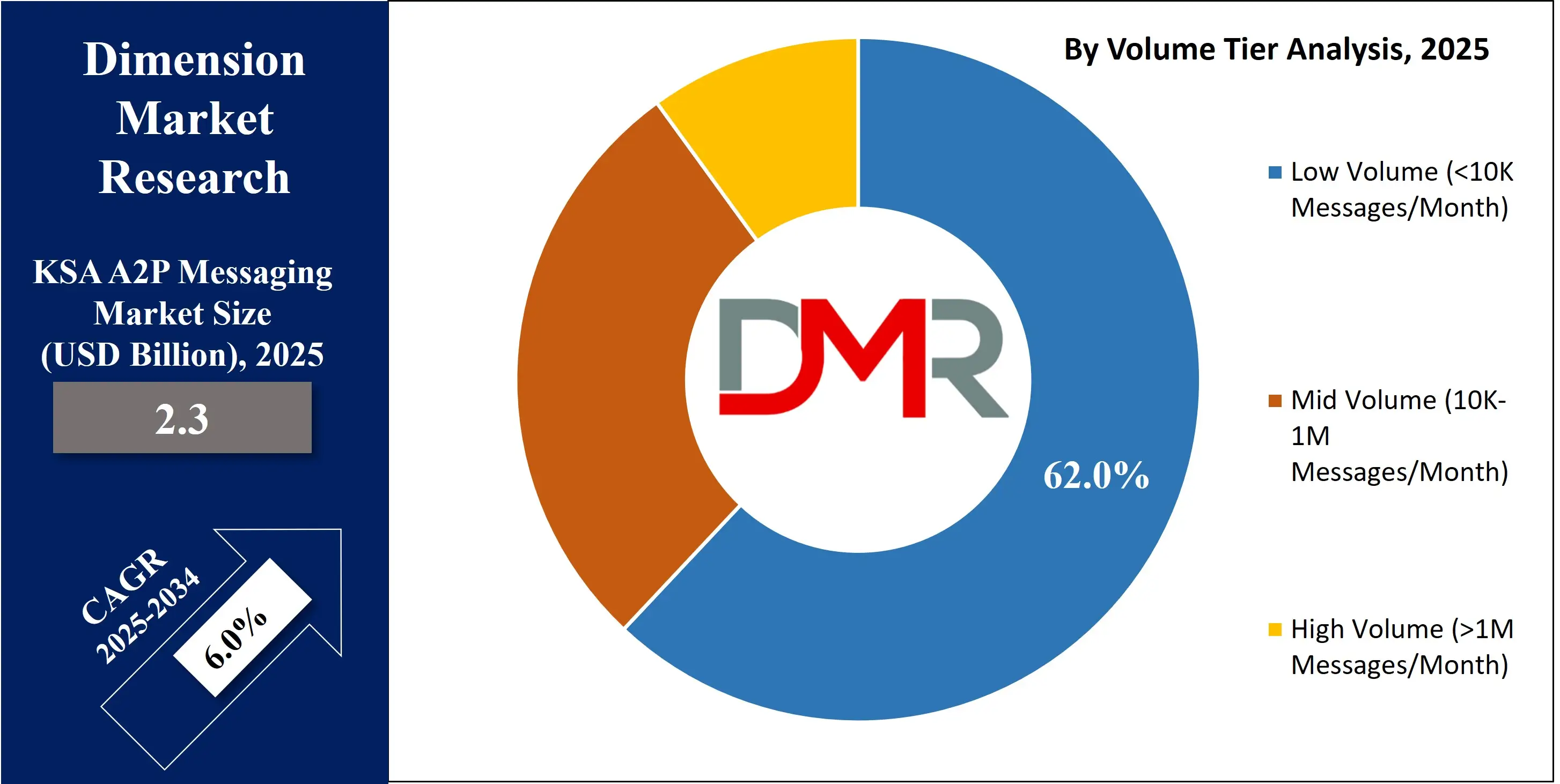

- By Volume Tier Segment Analysis: High Volume (>1M Messages/Month) will lead in the volume tier segment, capturing 62.0% of the market share in 2025.

- By Messaging Channel Segment Analysis: SMS are expected to maintain their dominance in the messaging channel segment, capturing 64.0% of the total market share in 2025.

- By Application Segment Analysis: Authentication Services will dominate the application segment, capturing 32.0% of the market share in 2025.

- By Industry Vertical Segment Analysis: The BFSI industry will dominate the industry vertical segment, capturing 24.0% of the market share in 2025.

- Key Players: Some key players in the KSA A2P messaging market are STC (Saudi Telecom Company), Mobily (Etihad Etisalat), Zain KSA, Unifonic, Cequens, Solutions by STC, IOT Squared, Taqniyat Telecom, Brmaja IT Solutions, Integra Technologies, Mada SMS, Skyzon, Link Development, Gulf Infotech, and Others.

KSA A2P Messaging Market: Use Cases

- Secure OTP and Transaction Alerts: Banks and fintech platforms in Saudi Arabia heavily rely on A2P messaging to deliver one-time passwords (OTPs), transaction confirmations, and account activity alerts to customers in real-time. This use case supports secure mobile banking, enabling two-factor authentication (2FA) and fraud prevention across digital banking apps. With growing adoption of online financial services, banks such as Al Rajhi, SNB, and STC Pay use SMS messaging and WhatsApp Business API to ensure trusted and compliant communication. The high delivery rate and immediacy of A2P messages help financial institutions meet regulatory mandates from SAMA while enhancing user trust and digital onboarding experiences.

- Public Service Notifications and Citizen Engagement: The Saudi government, under Vision 2030, has integrated A2P messaging into several digital public service platforms including Absher, Tawakkalna, and Seha. Citizens receive automated alerts about appointment confirmations, vaccine reminders, permit approvals, and traffic violations through SMS and push notifications. These services rely on A2P messaging to ensure timely delivery and high accessibility across all demographics, even those without smartphones. As part of the smart city and e-governance transformation, A2P enables transparent and efficient communication between government entities and the public, contributing to streamlined service delivery and enhanced digital citizen experiences.

- Promotional Campaigns and Order Updates: Retailers and e-commerce players in Saudi Arabia use A2P messaging to drive customer engagement, deliver personalized promotions, and send real-time order status updates. Businesses like Noon, Amazon.sa, and local online shops utilize WhatsApp Business messaging and bulk SMS campaigns to notify customers about flash sales, loyalty program offers, and cart abandonment reminders. In addition, order confirmations, delivery tracking, and payment receipts are routinely sent via A2P channels. This approach helps brands improve conversion rates, reduce return-to-origin costs, and provide a seamless shopping experience aligned with consumer expectations in a mobile-first market.

- Appointment Reminders and Patient Communication: Hospitals, clinics, and telemedicine platforms in Saudi Arabia utilize A2P messaging to manage appointment scheduling, test result notifications, and patient follow-ups. Institutions such as Dr. Sulaiman Al Habib Group and Seha leverage SMS alerts and RCS messaging to reduce no-show rates and keep patients informed. Healthcare providers also use automated messaging for vaccination drives, health awareness campaigns, and post-discharge care instructions. These A2P use cases support the Kingdom’s efforts to modernize healthcare services, improve patient outcomes, and facilitate efficient communication in both urban and rural areas.

Impact of Artificial Intelligence in KSA A2P Messaging Market

- Personalized Messaging at Scale: AI enables hyper-personalized A2P messaging by analyzing user behavior, preferences, and past interactions. In KSA, businesses across banking, retail, and telecom are using AI to send targeted promotions, timely reminders, and contextual alerts, increasing engagement and conversion rates while reducing customer churn.

- Intelligent Automation through Chatbots: AI-powered chatbots and virtual agents are streamlining two-way interactions over A2P channels. From appointment confirmations to payment reminders and service updates, these tools reduce manual workloads and enhance real-time communication, especially in sectors like healthcare and government services.

- Optimized Delivery and Traffic Management: AI helps determine the optimal time, channel, and format for message delivery by analyzing traffic patterns and user activity. It minimizes message failure rates and boosts campaign effectiveness, ensuring messages reach users during high-engagement windows.

- Enhanced Security and Fraud Detection: In security-sensitive industries like BFSI, AI is used to monitor message traffic for anomalies and block suspicious activity such as phishing or spoofing. This ensures secure transmission of OTPs and transactional alerts, strengthening trust in A2P communication.

- Predictive Campaign Insights: AI-driven analytics provide actionable insights into customer behavior, allowing businesses to forecast outcomes like open rates and user responses. This supports smarter decision-making and real-time campaign adjustments to improve ROI.

KSA A2P Messaging Market: Stats & Facts

- Communications, Space and Technology Commission (CST) – via Saudi Gazette

- Mobile internet speeds in KSA averaged 129 Mbps in 2024, ranking the country 4th among G20 nations.

- Mobile subscriptions in the Kingdom totaled 68.2 million, with 7% annual growth.

- The Saudi space sector recorded a market volume of SAR 7.1 billion in 2024.

- ICT‑listed companies in KSA hold SAR 255 billion in assets, SAR 128 billion in revenues, and a total market capitalization of SAR 427 billion.

- CST – Saudi Internet Report 2024

- Internet penetration in KSA reached 99% in 2024.

- 99.4% of internet access in KSA was via mobile devices.

- Peak online usage occurs daily between 9–11 PM, with Saturdays being the busiest.

- Average monthly mobile data usage per person stood at 48 GB, nearly three times the global average.

- 93.1% of e‑commerce purchases in KSA were made through local websites.

- 21.5% of internet users in the Kingdom regularly use AI-based tools.

- Saudi domain registrations grew by 25% annually, which is eight times the global average.

- CST – Makkah Telecom Report (Hajj Period 2024)

- Total voice calls reached 42.2 million in a single day, with a 99% call success rate.

- Data consumption totaled 5.61 thousand TB, equivalent to 2.3 million hours of HD video.

- Daily per-user data usage was 761.93 MB, more than double the global average.

- Mobile internet download speeds averaged 386.66 Mbps; upload speeds were 48.79 Mbps.

- Ministry of Communications and Information Technology (MCIT) – Digital Inclusion and 5G Readiness

- Network coverage in KSA: 100% cellular, 99% 3G, 94% 4G

- Mobile phone ownership reached 97% among residents

- Active mobile broadband subscriptions exceeded 117 per 100 inhabitants

- Saudi Arabia ranked 7th globally in mobile internet speed and 4th in 5G speed

- By the end of 2020, 5,358 new 5G towers had been deployed, bringing the national total to 12,302.

KSA A2P Messaging Market: Market Dynamics

KSA A2P Messaging Market: Driving Factors

Acceleration of Digital Transformation across Key SectorsSaudi Arabia’s Vision 2030 has triggered a comprehensive digital transformation across government services, banking, retail, healthcare, and logistics. With more services moving online, the need for secure and scalable communication is rising sharply. A2P messaging, particularly through SMS gateways and WhatsApp Business APIs, is critical for delivering real-time authentication, alerts, and service notifications. As mobile-first platforms proliferate, businesses are adopting cloud-based messaging infrastructure to automate communication workflows and enhance operational efficiency.

Increasing Smartphone and Internet Penetration

The Kingdom has one of the highest smartphone and internet penetration rates in the Middle East, with over 90 percent of the population using mobile devices for daily transactions. This digital readiness supports the growth of A2P communication channels such as push notifications, RCS messaging, and app-based alerts. Enterprises leverage these platforms to boost customer interaction, send personalized updates, and support two-way conversations that improve overall customer experience and brand loyalty.

KSA A2P Messaging Market: Restraints

Limited Adoption of Advanced Messaging Channels like RCS

While Rich Communication Services (RCS) offer enhanced capabilities such as multimedia messages and interactive buttons, their adoption remains slow in the Saudi market. Factors such as device compatibility issues, limited carrier readiness, and low end-user awareness act as barriers. As a result, many businesses still rely heavily on traditional SMS despite its limited engagement potential, which slows the transition to next-generation messaging channels.

Regulatory Restrictions and Spam Control Measures

Strict regulations imposed by the Communications, Space and Technology Commission (CST) in Saudi Arabia are designed to prevent spam and unsolicited messaging. While these controls protect consumers, they also pose challenges for marketers and service providers in terms of message approval processes, keyword restrictions, and content filtering. These compliance requirements can delay campaigns and reduce messaging flexibility, especially for SMEs without access to direct telecom operator routes.

KSA A2P Messaging Market: Opportunities

Rising Demand for CPaaS Integration in Enterprise Workflows

Saudi enterprises are adopting Communications Platform as a Service (CPaaS) solutions that integrate A2P messaging into CRM, ERP, and e-commerce systems. This trend opens opportunities for platform providers to offer APIs for automated workflows such as billing reminders, logistics updates, and support ticketing. With growing demand for multi-channel messaging solutions, local vendors can capitalize by providing tailored CPaaS offerings with analytics, personalization, and language support for Arabic-speaking users.

Expansion of A2P Use Cases in Healthcare and Education

There is a growing need for reliable messaging infrastructure in healthcare and education sectors, particularly for telemedicine platforms, digital learning environments, and patient engagement apps. Hospitals, clinics, universities, and e-learning providers are adopting SMS alerts and push notifications for appointment scheduling, exam reminders, test results, and class updates. As these sectors modernize, the potential for specialized A2P services expands significantly, enabling providers to offer sector-specific communication solutions.

KSA A2P Messaging Market: Trends

Shift toward Omnichannel Messaging Strategies

Businesses in KSA are moving from single-channel communication to omnichannel engagement strategies. This involves the seamless use of SMS, WhatsApp, push notifications, and RCS within a unified platform to create a consistent customer journey. Omnichannel messaging improves response rates, supports personalized content delivery, and enables cross-platform interactions, making it a key trend among enterprises aiming to differentiate through customer-centric communication models.

Emergence of AI-Powered Messaging Automation

Artificial intelligence is becoming integral to the evolution of A2P messaging in Saudi Arabia. AI-driven tools are now used to automate message routing, personalize content, and analyze delivery performance in real time. Enterprises are also adopting chatbots integrated with WhatsApp and SMS, enabling automated FAQs, service updates, and appointment booking through natural language interfaces. This trend enhances scalability, reduces manual intervention, and supports 24/7 customer service in both English and Arabic.

KSA A2P Messaging Market: Research Scope and Analysis

By Component Analysis

In the KSA A2P messaging market, the platform component is expected to hold the majority share, accounting for approximately 61.0% of the total market in 2025. This dominance is largely due to the growing enterprise demand for scalable, API-driven messaging platforms that can support a wide range of communication needs, from transactional alerts and OTPs to promotional campaigns and customer support. These platforms enable businesses to automate message delivery, integrate with existing CRM or ERP systems, and manage large volumes of outbound messages across multiple channels such as SMS, WhatsApp, RCS, and push notifications. The growing reliance on cloud-based communication infrastructure, especially in sectors like banking, retail, and government services, has further driven the adoption of robust messaging platforms that offer flexibility, security, and real-time analytics.

On the other hand, the services segment includes a variety of support functions such as implementation, system integration, managed services, consulting, and maintenance. These services are essential for organizations that require customized messaging workflows, regulatory compliance assistance, or technical support for integrating A2P solutions into their digital ecosystems. In KSA, where businesses are at different stages of digital maturity, service providers play a key role in helping companies configure messaging strategies that align with local market needs and user behavior. Although the services segment holds a smaller market share compared to platforms, it remains critical for ensuring seamless deployment, optimizing campaign performance, and maintaining long-term operational efficiency in A2P messaging environments.

By Deployment Mode Analysis

In the KSA A2P messaging market, cloud-based deployment is expected to dominate the deployment mode segment, accounting for around 73.0% of the total market share in 2025. This strong preference for cloud deployment is being driven by the growing demand for scalability, flexibility, and cost-efficiency among enterprises across sectors such as banking, retail, logistics, and public services.

Cloud-based platforms allow organizations to manage large volumes of messages without investing heavily in physical infrastructure. They offer rapid deployment, easy integration with digital ecosystems, and remote accessibility, which is particularly valuable in a fast-paced, mobile-driven environment like KSA. Moreover, cloud solutions support multi-channel delivery, real-time analytics, and API-based customization, making them ideal for businesses seeking agile communication strategies and rapid scalability in customer engagement.

In contrast, on-premise deployment, while less dominant, continues to serve organizations that require full control over their messaging infrastructure due to compliance, security, or data localization concerns. Certain government agencies, financial institutions, or large enterprises with strict internal IT policies may opt for on-premise solutions to manage sensitive data in-house. These systems are typically custom-built, offer higher degrees of customization, and are integrated tightly with internal networks. However, they involve higher upfront costs, longer implementation timelines, and ongoing maintenance responsibilities. As a result, while on-premise solutions remain relevant in specific use cases, their adoption is limited compared to the growing preference for cloud-based A2P messaging platforms in KSA.

By Volume Tier Analysis

In the KSA A2P messaging market, the high-volume segment, defined as sending more than one million messages per month, is expected to dominate the market in 2025 with a projected share of 62.0%. This segment is primarily driven by large-scale enterprises, telecom providers, government platforms, and financial institutions that depend on continuous, high-frequency communication with large user bases.

Use cases in this tier include two-factor authentication, transaction alerts, appointment confirmations, and mass public service notifications. Entities such as banks, e-government services, airlines, and major e-commerce platforms consistently generate millions of messages monthly, making high-volume A2P messaging a critical part of their digital communication infrastructure. The high reliability, speed, and reach of A2P channels like SMS, WhatsApp Business API, and push notifications make them essential for customer engagement at scale.

The mid-volume tier, which covers organizations sending between 10,000 and 1 million messages per month, is also a significant segment, especially among mid-sized businesses and specialized service providers. This group includes private hospitals, educational institutions, regional logistics operators, and retail chains that use A2P messaging for appointment reminders, shipment tracking, promotional campaigns, and customer support. Representing a projected 28.0% of the market in 2025, the mid-volume segment benefits from growing digital adoption among growing businesses that require dependable yet flexible communication tools without the infrastructure demands of high-volume operations. These organizations are turning to CPaaS platforms and cloud-based messaging services to scale their communication in a cost-effective and efficient manner.

By Messaging Channel Analysis

In the KSA A2P messaging market, SMS is expected to maintain its dominant position in the messaging channel segment, accounting for approximately 64.0% of the total market share in 2025. This stronghold is largely due to the widespread compatibility of SMS across all mobile devices, regardless of internet connectivity or smartphone type. It remains the most trusted and widely adopted communication channel for critical use cases such as OTPs, banking alerts, government notifications, and service confirmations. The reliability, instant delivery, and high open rates of SMS make it a preferred choice among telecom operators, banks, healthcare providers, and government agencies in KSA. Additionally, regulatory support and established telecom infrastructure continue to reinforce SMS as the default A2P messaging standard in the region.

While still emerging, RCS (Rich Communication Services) is gradually gaining attention in the KSA market as an advanced alternative to traditional SMS. Offering rich media capabilities such as images, buttons, carousels, and real-time interactions, RCS is designed to provide a more engaging and app-like messaging experience. It is particularly appealing to brands seeking interactive customer engagement without relying on third-party apps. However, its adoption in KSA remains limited due to inconsistent device support, lack of full carrier interoperability, and relatively low user awareness. Despite these challenges, RCS is projected to grow steadily as telecom operators and CPaaS providers explore pilot projects, especially in sectors like retail and financial services where visual communication and real-time engagement can enhance the user journey. As infrastructure and adoption improve, RCS may emerge as a complementary channel alongside SMS in the coming years.

By Application Analysis

In the KSA A2P messaging market, authentication services are expected to lead the application segment, accounting for approximately 32.0% of the total market share in 2025. This dominance is driven by the growing need for secure and real-time identity verification across sectors such as banking, e-government, fintech, and e-commerce. Services like one-time passwords (OTPs), two-factor authentication (2FA), and login verifications are essential for protecting user accounts, processing digital transactions, and maintaining compliance with cybersecurity regulations. With the growing adoption of mobile banking, digital wallets, and online service platforms, authentication messages have become a critical component of daily user interaction. The reliability and immediacy of A2P channels, particularly SMS and WhatsApp Business API, ensure secure delivery of sensitive information, making them indispensable tools for fraud prevention and user verification.

Promotional and marketing services also hold a significant share in the KSA A2P messaging landscape, used widely by retailers, service providers, and e-commerce businesses to drive customer engagement and sales. These messages include limited-time offers, loyalty rewards, personalized recommendations, and event-based promotions. With high smartphone usage and mobile-first consumer behavior in the Kingdom, A2P messaging has proven to be an effective tool for reaching large audiences quickly and directly. Businesses use bulk SMS, push notifications, and rich media messaging through platforms like RCS and WhatsApp to create more interactive and personalized campaigns. While this segment does not match authentication services in volume, it plays a key role in brand visibility, customer retention, and revenue generation, especially as competition grows in the digital marketplace.

By Industry Vertical Analysis

In the KSA A2P messaging market, the BFSI (Banking, Financial Services, and Insurance) industry is projected to dominate the industry vertical segment, accounting for around 24.0% of the total market share in 2025. This dominance is driven by the sector's critical reliance on secure, real-time communication for customer authentication, transaction alerts, fraud detection, and account activity notifications. Banks, digital wallets, and insurance providers in KSA use A2P messaging channels such as SMS and WhatsApp Business API to facilitate two-factor authentication (2FA), send one-time passwords (OTPs), and confirm high-value transactions. As financial institutions rapidly expand their digital offerings, the demand for reliable and scalable messaging infrastructure continues to grow. The BFSI sector also benefits from regulatory support encouraging secure digital communications and the adoption of mobile banking, which is fueling the consistent use of A2P messaging to enhance user trust and operational efficiency.

Retail and e-commerce is another key vertical contributing significantly to the growth of the A2P messaging market in KSA. As online shopping platforms, hypermarkets, and direct-to-consumer brands increase their digital footprint, A2P messaging has become an essential tool for customer engagement, promotional outreach, and order-related communication. Retailers use messaging services to notify customers about flash sales, new arrivals, personalized discount codes, and loyalty program updates, while e-commerce companies rely on SMS, WhatsApp, and push notifications to send order confirmations, shipping updates, and delivery tracking information. This sector is benefiting from Saudi Arabia’s expanding digital consumer base, high mobile penetration, and growing trust in online payments. As competition intensifies, businesses are adopting omnichannel messaging strategies and rich media campaigns to improve customer experience and boost conversion rates, solidifying the role of A2P messaging in retail and e-commerce operations.

The KSA A2P Messaging Market Report is segmented on the basis of the following

By Component

By Deployment Mode

By Volume Tier

- Low Volume (<10K Messages/Month)

- Mid Volume (10K-1M Messages/Month)

- High Volume (>1M Messages/Month)

By Messaging Channel

- SMS

- RCS

- OTT Messaging Apps

- Push Notifications

- Others

By Application

- Authentication Services

- Promotional and Marketing Services

- Pushed Content Services

- Interactive Messages Services

- Customer Relationship Management (CRM)

- Others

By Industry Vertical

- BFSI

- Retail & E-commerce

- Telecom & IT

- Government

- Healthcare

- Travel & Hospitality

- Education

- Others

KSA A2P Messaging Market: Competitive Landscape

The competitive landscape of the KSA A2P messaging market is characterized by a dynamic mix of telecom giants, regional CPaaS providers, and emerging technology firms competing to serve a rapidly growing digital economy. Major telecom operators such as STC, Mobily, and Zain KSA leverage their direct network infrastructure and extensive enterprise client base to dominate high-volume messaging traffic, especially for mission-critical use cases like banking authentication and government communications. Meanwhile, regional players like Unifonic, Cequens, and Solutions by STC are gaining traction through API-first, cloud-native platforms that offer multi-channel messaging, AI-driven automation, and integrations with CRM and ERP systems.

These CPaaS providers cater to the mid- and low-volume enterprise segments, offering greater flexibility and customization. The market is also seeing increased activity from system integrators and IT consultancies such as Link Development and Integra Technologies, who support end-to-end deployment and digital transformation initiatives. As KSA's digital ecosystem matures, competition is intensifying around value-added services, platform innovation, and sector-specific messaging solutions, positioning the market as both competitive and innovation-focused.

Some of the prominent players in the KSA A2P messaging market are

- STC (Saudi Telecom Company)

- Mobily (Etihad Etisalat)

- Zain KSA

- Unifonic

- Cequens

- Solutions by STC

- IOT Squared

- Taqniyat Telecom

- Brmaja IT Solutions

- Integra Technologies

- Mada SMS

- Skyzon

- Link Development

- Gulf Infotech

- QualityNet

- SMSCountry

- Netways Arabia

- Mitgo Middle East

- BMIT Technologies

- Tata Communications (Middle East Division)

- Other Key Players

KSA A2P Messaging Market: Recent Developments

- April 2025: Saudi digital signature platform Sadq closed a pre-Series A funding of USD 1.5 million led by X by Unifonic Fund, supporting growth in digital authentication services within KSA.

- March 2025: Unifonic reported a total fundraising of USD 146 million across two rounds from seven investors, including SoftBank Vision Fund and Endeavor, underlining strong investor confidence in its CPaaS expansion.

- February 2025: Salam partners with Mada to launch international A2P messaging services, enhancing two-factor authentication and automated notifications across the Middle East.

- January 2024: Cequens rolls out a preferred partnership with Lebara KSA to monetize international A2P SMS traffic, improving delivery, scalability, and spam filtering for enterprises.

- October 2023: Tata Communications acquired Kaleyra for approximately USD 100 million, expanding its global CPaaS and A2P messaging capabilities.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2.3 Bn |

| Forecast Value (2033) |

USD 4.0 Bn |

| CAGR (2024-2033) |

6.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Platform and Services), By Deployment Mode (Cloud-Based and On-Premise), By Volume Tier (Low Volume, Mid Volume, and High Volume), By Messaging Channel (SMS, RCS, OTT Messaging Apps, Push Notifications, and Others), By Application (Authentication Services, Promotional and Marketing Services, Pushed Content Services, Interactive Messages Services, Customer Relationship Management (CRM), and Others), and By Industry Vertical (BFSI, Retail & E-commerce, Telecom & IT, Government, Healthcare, Travel & Hospitality, Education, and Others). |

| Regional Coverage |

The Kingdom of Saudi Arabia (KSA) |

| Prominent Players |

STC (Saudi Telecom Company), Mobily (Etihad Etisalat), Zain KSA, Unifonic, Cequens, Solutions by STC, IOT Squared, Taqniyat Telecom, Brmaja IT Solutions, Integra Technologies, Mada SMS, Skyzon, Link Development, Gulf Infotech, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The KSA A2P messaging market size is estimated to have a value of USD 2.3 billion in 2025 and is expected to reach USD 4.0 billion by the end of 2034.

Some of the major key players in the KSA A2P messaging market are STC (Saudi Telecom Company), Mobily (Etihad Etisalat), Zain KSA, Unifonic, Cequens, Solutions by STC, IOT Squared, Taqniyat Telecom, Brmaja IT Solutions, Integra Technologies, Mada SMS, Skyzon, Link Development, Gulf Infotech, and Others.

The market is growing at a CAGR of 6.0 percent over the forecasted period.